Council tax charges and information for Erewash properties from April 2024.

Council Tax

The element of Council Tax that Erewash Borough Council collects as a Billing Authority on behalf of Derbyshire County Council, Derbyshire Police and Crime Commissioner, Derbyshire Fire and Rescue Authority and parish Councils can be found in the relevant leaflets accompanying this bill.

View a digital council tax leaflet for the Derbyshire Police and Crime Commissioner: derbyshire-pcc.gov.uk

View council tax information for Derbyshire Fire & Rescue Service: derbys-fire.gov.uk

View council tax information for Derbyshire County Council: derbyshire.gov.uk

Your Council Tax charge 2024/25

| Your Council Tax Charge 2024/25 | BAND A | BAND B | BAND C | BAND D | BAND E | BAND F | BAND G | BAND H |

|---|---|---|---|---|---|---|---|---|

| BREADSALL | 1,459.42 | 1,702.66 | 1,945.90 | 2,189.13 | 2,675.60 | 3,162.08 | 3,648.55 | 4,378.26 |

| BREASTON | 1,473.06 | 1,718.57 | 1,964.08 | 2,209.59 | 2,700.61 | 3,191.63 | 3,682.65 | 4,419.18 |

| DALE ABBEY | 1,454.05 | 1,696.39 | 1,938.73 | 2,181.07 | 2,665.75 | 3,150.44 | 3,635.12 | 4,362.14 |

| DRAYCOTT | 1,481.61 | 1,728.54 | 1,975.48 | 2,222.41 | 2,716.28 | 3,210.15 | 3,704.02 | 4,444.82 |

| LITTLE EATON | 1,454.05 | 1,696.39 | 1,938.73 | 2,181.07 | 2,665.75 | 3,150.44 | 3,635.12 | 4,362.14 |

| MORLEY | 1,443.34 | 1,683.89 | 1,924.45 | 2,165.00 | 2,646.11 | 3,127.22 | 3,608.34 | 4,330.00 |

| OCKBROOK AND BORROWASH | 1,460.28 | 1,703.65 | 1,947.04 | 2,190.41 | 2,677.17 | 3,163.93 | 3,650.69 | 4,380.82 |

| RISLEY WITH HOPWELL | 1,460.74 | 1,704.20 | 1,947.66 | 2,191.11 | 2,678.02 | 3,164.94 | 3,651.85 | 4,382.22 |

| SANDIACRE | 1,446.21 | 1,687.24 | 1,928.28 | 2,169.31 | 2,651.38 | 3,133.45 | 3,615.52 | 4,338.62 |

| SAWLEY | 1,440.60 | 1,680.69 | 1,920.80 | 2,160.89 | 2,641.09 | 3,121.29 | 3,601.49 | 4,321.78 |

| STANLEY AND STANLEY COMMON | 1,456.08 | 1,698.75 | 1,941.44 | 2,184.11 | 2,669.47 | 3,154.83 | 3,640.19 | 4,368.22 |

| STANTON -BY-DALE | 1,536.23 | 1,792.26 | 2,048.31 | 2,304.34 | 2,816.42 | 3,328.49 | 3,840.57 | 4,608.68 |

| WEST HALLAM | 1,449.40 | 1,690.97 | 1,932.54 | 2,174.10 | 2,657.23 | 3,140.37 | 3,623.50 | 4,348.20 |

| NON PARISHED AREAS | 1,422.38 | 1,659.44 | 1,896.51 | 2,133.57 | 2,607.70 | 3,081.83 | 3,555.95 | 4,267.14 |

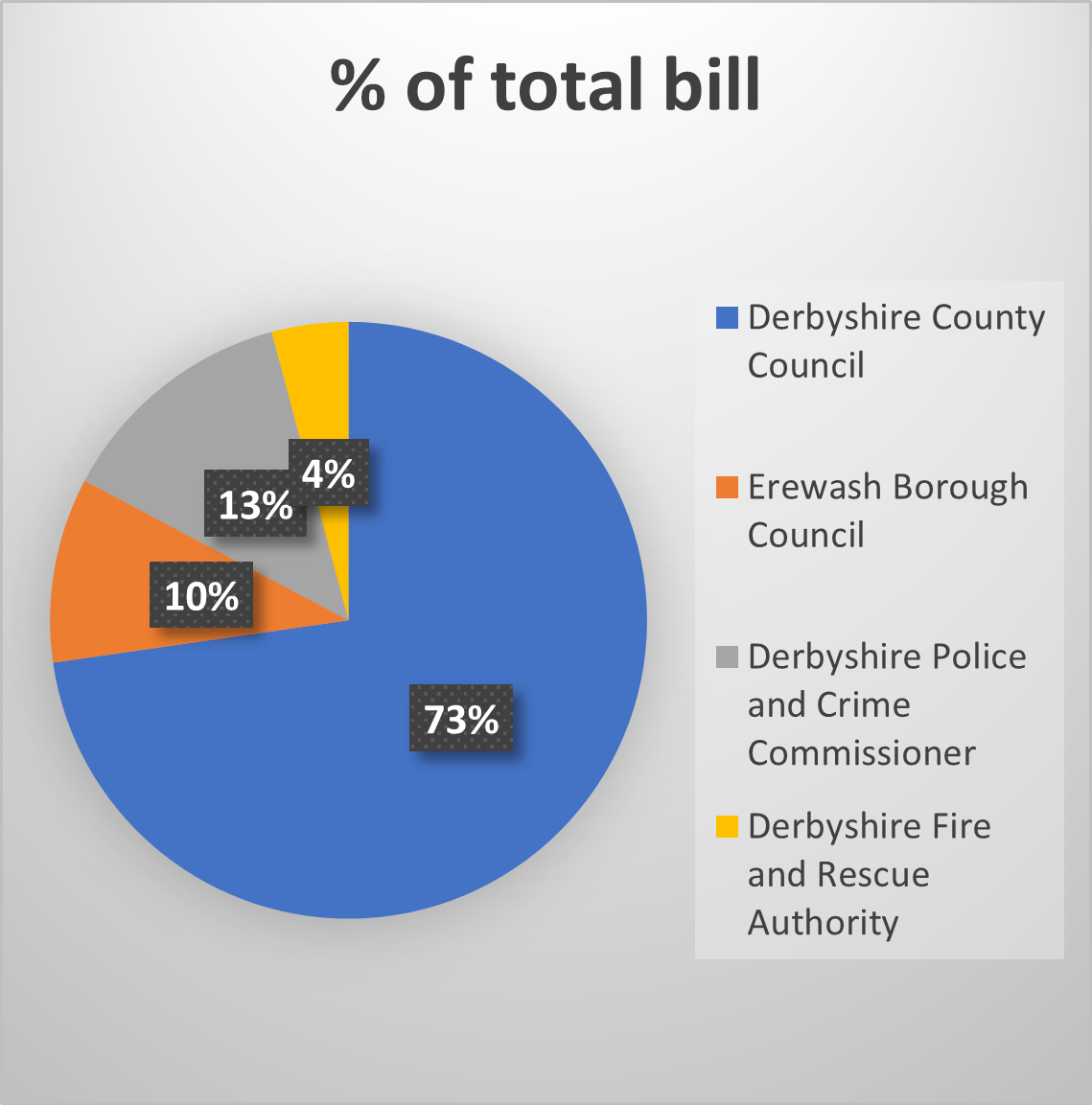

| Who spends your money? | % of total bill | Last year 2023/24 | This year 2024/25 | % increase |

|---|---|---|---|---|

| Derbyshire County Council | 72.7% | £1,477.98 | £1,551.73 | 4.99% |

| Erewash Borough Council | 10.0% | £207.62 | £213.83 | 2.99% |

| Derbyshire Police and Crime Commissioner | 13.1% | £266.60 | £279.60 | 4.88% |

| Derbyshire Fire and Rescue Authority | 4.1% | £85.84 | £88.41 | 2.99% |

| Total | 100% | £2,038.04 | £2,133.57 | 4.69% |

Adult Social Care

For adult social care authorities, council tax bills show two percentage changes: one for the overall change attributable to the adult social care precept, and one for the part attributable to general expenditure.

Adult social care authorities are local authorities which have functions under Part 1 of the Care Act 2014, namely county councils, London borough councils, the Common Council of the City of London and the Council of the Isles of Scilly.

These authorities have the option to charge an additional precept on its council tax without holding a referendum, to assist the authority in meeting its expenditure on adult social care. If the Secretary of State chooses to renew this option in respect of a particular financial year, this is subject to the approval of the House of Commons.

What you pay

| What you pay | Band A | Band B | Band C | Band D | Band E | Band F | Band G | Band H |

|---|---|---|---|---|---|---|---|---|

| Derbyshire County Council | 1,034.49 | 1,206.90 | 1,379.32 | 1,551.73 | 1,896.56 | 2,241.39 | 2,586.22 | 3,103.46 |

| Erewash Borough Council | 142.55 | 166.31 | 190.07 | 213.83 | 261.35 | 308.87 | 356.38 | 427.66 |

| Derbyshire Police and Crime Commissioner | 186.40 | 217.47 | 248.53 | 279.60 | 341.73 | 403.87 | 466.00 | 559.20 |

| Derbyshire Fire and Rescue Authority | 58.94 | 68.76 | 78.59 | 88.41 | 108.06 | 127.70 | 147.35 | 176.82 |

| Total | 1,422.38 | 1,659.44 | 1,896.51 | 2,133.57 | 2,607.70 | 3,081.83 | 3,555.95 | 4,267.14 |

Erewash Borough Council Council Tax Requirement

| Erewash Borough Council | 2023/24 | 2024/25 |

|---|---|---|

| Council Tax Requirement | £m | £m |

| Gross Expenditure | 39.7 | 40.2 |

| Less Income | -25.5 | -26.1 |

| Net Expenditure | 14.2 | 14.1 |

| Less Contributions (from)/to balances | -1.3 | 0.0 |

| Net Budget | 12.9 | 14.1 |

| Less Central Government Support | -0.7 | -0.8 |

| Less Business Rates Retention | -5.0 | -5.9 |

| Council Tax Requirement | 7.2 | 7.4 |

| Add Parish Precepts | 0.5 | 0.7 |

| Total Council Tax Requirement | 7.7 | 8.1 |

| Derbyshire County Council Precept | 51.2 | 53.6 |

| Derbyshire Police and Crime Commissioner | 9.2 | 9.6 |

| Derbyshire Fire and Rescue Authority | 3.0 | 3.1 |

| Total Council Tax Requirement for all Authorities | 71.1 | 74.4 |

Parish Council Charges

| Parish Council Charges | Parish Precept 2024/25 | Parish Band D Charge 2024/25 |

|---|---|---|

| BREADSALL | 22,000 | 55.56 |

| BREASTON | 127,707 | 76.02 |

| DALE ABBEY | 19,817 | 47.50 |

| DRAYCOTT | 87,403 | 88.84 |

| LITTLE EATON | 43,425 | 47.50 |

| MORLEY | 5,600 | 31.43 |

| OCKBROOK AND BORROWASH | 139,341 | 56.84 |

| RISLEY WITH HOPWELL | 18,400 | 57.54 |

| SANDIACRE | 96,500 | 35.74 |

| SAWLEY | 49,299 | 27.32 |

| STANLEY AND STANLEY COMMON | 36,101 | 50.54 |

| STANTON-BY-DALE | 33,574 | 170.77 |

| WEST HALLAM | 64,629 | 40.53 |

| Total | 743,796 | n/a |